News

“Building America … On a Strong Foundation:” BAM’s 2016 Year-End Review

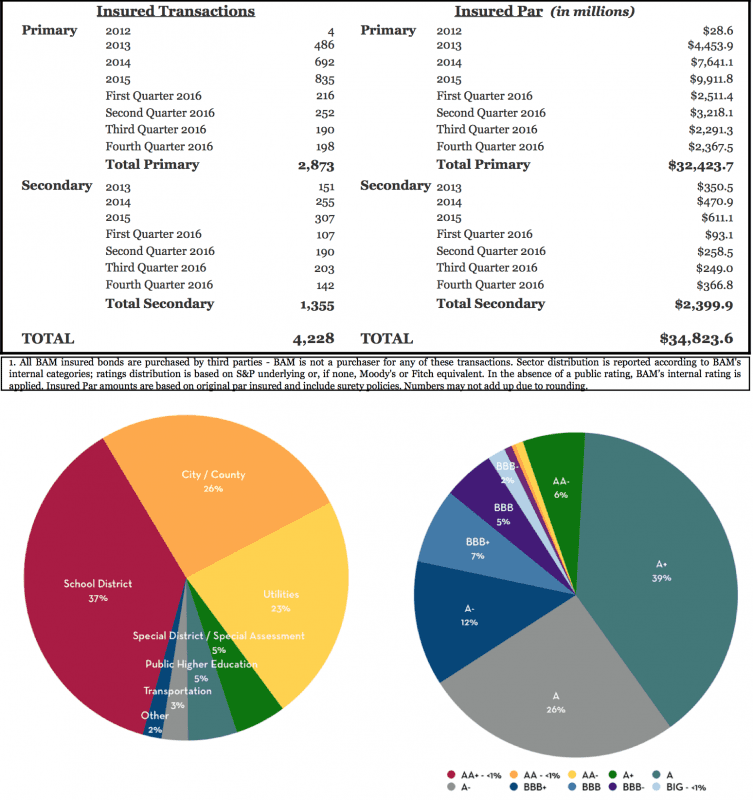

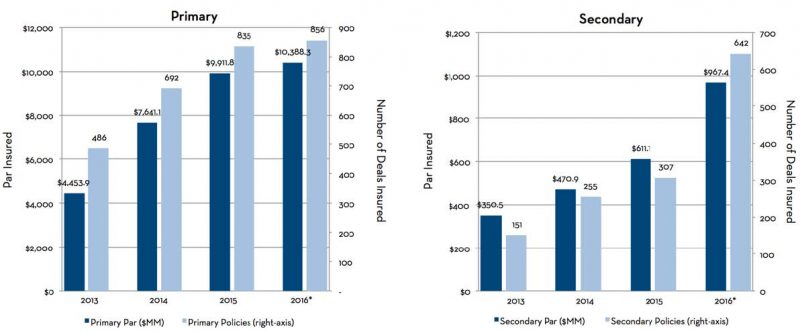

Like you, we at BAM are ready to hit the ground running, supporting municipal issuers when they access the market to finance essential public infrastructure. More than 2,200 issuers have already become members of BAM, and we’ve now insured almost $35 billion, after another record year in 2016 ($11.4 billion par insured, including more than $950 million in the secondary market). In a challenging market, our insured bonds are a valuable source of liquidity: More than $500 million of BAM- insured bonds trade hands in the secondary market in a typical week, and insurance was used more frequently on AA-category credits when interest rates rose during the fourth quarter.

Importantly, BAM’s claims-paying resources also climbed in every quarter of 2016, reflecting the strength of our mutual insurance model. Without demands from shareholders for a quick payoff, we are free to manage BAM with a focus on building capital rather than generating financial returns through dividends or stock buybacks. That long-term perspective is also obvious in our low-risk portfolio of insured credits — 85% of BAM’s insured bonds carry underlying ratings of A-minus or better, and we have no exposure to Puerto Rico, non-municipal, or international credits.

Finally, we continued to invest to make the constantly-growing library of BAM Credit Profiles a go-to source for timely, easy to digest credit information. BAM Credit Profiles are now available prior to pricing for most negotiated transactions and immediately after the award for most competitive sales. For ongoing diligence and compliance, you can visit BAM’s web site to register for an email alert every time we update the BAM Credit Profiles covering your portfolio.

We want to take this moment at the start of the year to step back and thank the underwriters, municipal advisors, and investors who have utilized BAM on your transactions and helped us fulfill our mission to serve our municipal member-issuers. As new-money transactions move back to center stage in the primary market, BAM looks forward to continuing to work with all of you to help those members access the market as efficiently and affordably as possible, while also protecting investors with durable, transparent protection against default.

Sincerely,

Bob Cochran and Seán McCarthy

BAM Facts

- BAM continues to grow its capital organically with each transaction it insures which resulted in meaningful growth in BAM’s Claims Paying Resources in 2016

- Banner year in secondary market trading activity in 2016, with 642 policies executed for over $950 million par

- 107% increase in policies and 58% increase in par]

- More than 50 active counter parties

- Solid growth in insuring bonds with underlying AA- 0r higher rating category

- Big jump in activity on TMCBonds platform with 48% of the par insured on the site

- BAM trading volume has increased >120% over the last three years

- BAM Credit Profiles demand increased significantly in 2016

- BAM posted >1,000 new Credit Profiles to its website

- BAM updated >2,500 Credit Profiles

- >20% increase in views of Credit Profiles in 2016

- BAM’s in house pension actuary continues to assess impact of pensions on all transactions which BAM insures

- Assessment of more than 300 pension systems in 47 states and more than 1,000 OPEB plans in 2016 alone

- Continuing assessment of impact of new GASB regulations

And don’t forget

- BAM is a mutual insurer that only guarantees bonds for U.S. Municipal issuers and essential services like schools and water and sewer systems

- BAM has no exposure to Puerto Rico, private hospitals, international borrowers or structured finance

- A portion of every dollar of BAM primary-market premium can be utilized as a credit against the cost of a BAM insurance policy on any future refunding of those bonds

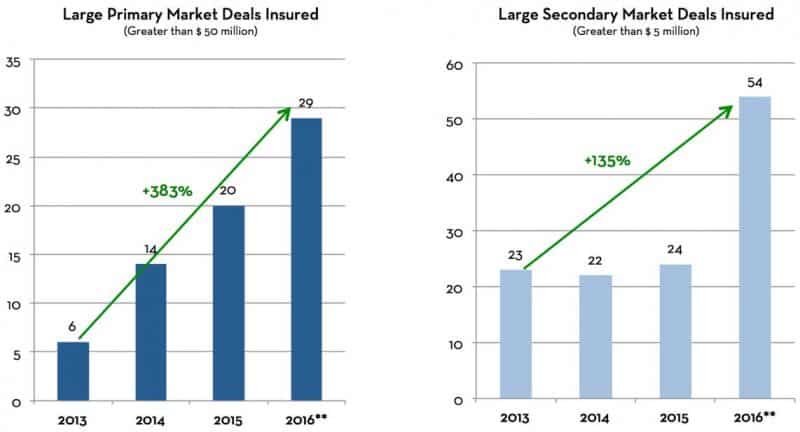

BAM Large Deal Growth

*As of December 30, 2016.

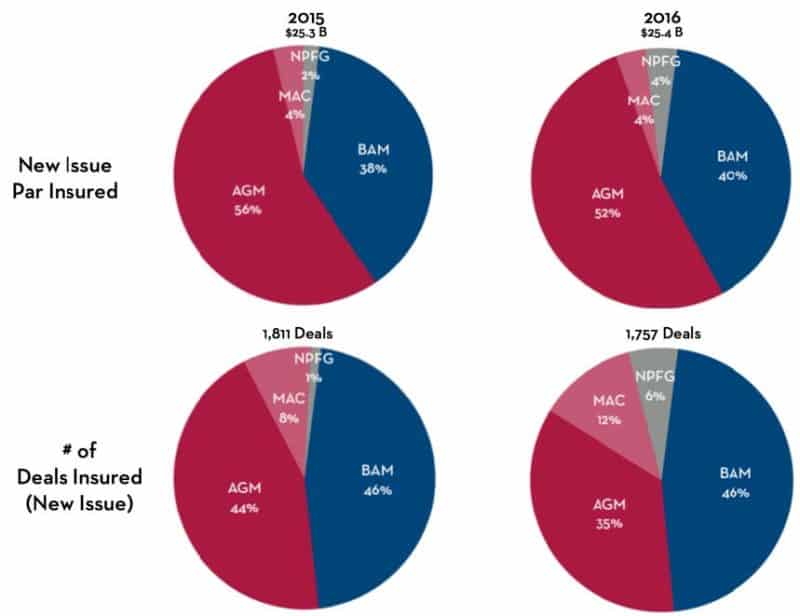

2016 Market Share

Source: The Bond Buyer / Thomson Financial / IPREO / BAM

*As of December 30, 2016.

BAM Cumulative Par

*As of December 30, 2016. All BAM insured bonds are purchased by third parties – BAM is not a purchaser for any of these transactions. Insured Par amounts are based on original par insured and include surety policies. Numbers may not add up due to rounding.

Insured Portfolio